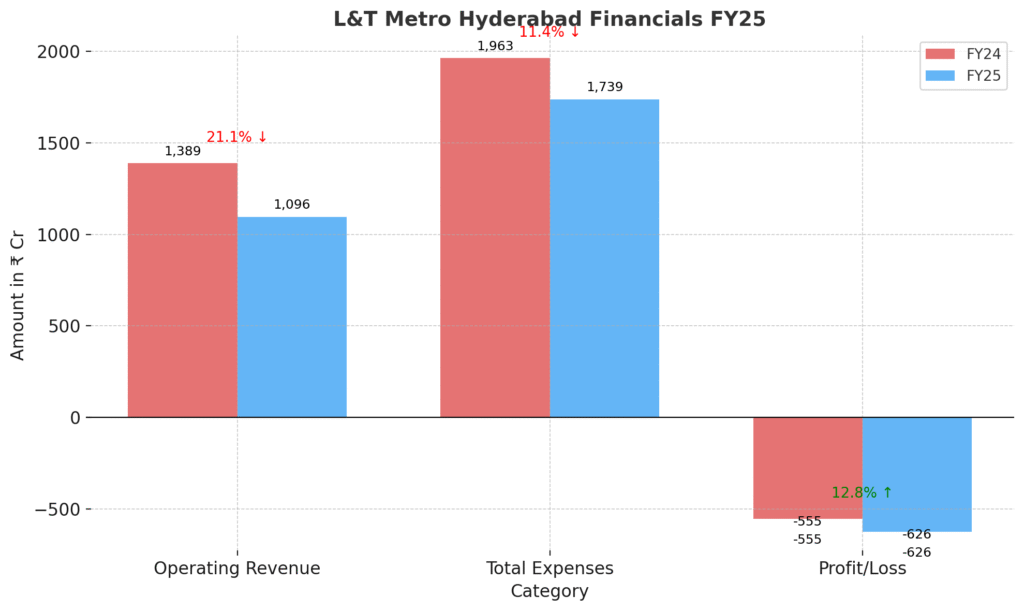

L&T Metro Rail (Hyderabad) Limited, the operator of the city’s urban rapid transit system, reported a widened loss of ₹625.88 crore in FY25, compared to ₹555.04 crore in the previous fiscal. The dip in total income and persistently high finance costs were key drivers of the steeper loss.

In FY25, fare revenue remained the company’s primary source of income, contributing ₹622 crore, up from ₹603 crore in FY24. Rental income grew modestly to ₹115 crore, while advertising income rose sharply by 30% YoY to ₹105 crore. However, revenue from real estate transfer—a one-time contributor—fell significantly to ₹187 crore from ₹512 crore last year, impacting the topline.`

Total income stood at ₹1,112.66 crore in FY25, down from ₹1,407.81 crore in FY24, despite the company earning ₹12.53 crore from other income sources including interest and miscellaneous revenue

On the expense side, finance costs continued to dominate, amounting to ₹940 crore in FY25, slightly lower than ₹1,173 crore in FY24. Operating expenses totaled ₹422 crore, followed by depreciation and amortization charges of ₹303 crore. Administrative and employee costs were also notable, at ₹31 crore and ₹38 crore, respectively

The company’s total expenditure for FY25 was ₹1,738.57 crore, compared to ₹1,962.85 crore a year earlier, marking a 11% decline. However, this reduction was not sufficient to offset the drop in income.

Despite steady core operational income, the company’s high debt servicing burden continues to weigh heavily on its bottom line. On a unit basis, L&T Metro Rail spent over ₹1.56 for every rupee it earned in operating revenue during the year, highlighting the capital-intensive nature of metro infrastructure and the pressure on financial sustainability in the absence of fare hikes or external support.